Two indicators that point to the new bitcoin ATH

However, more attentive examination of the on-alignment and technical indicators shows that this time the market conditions of bitcoins have shown significantly different and potentially more favorable for a new increase.

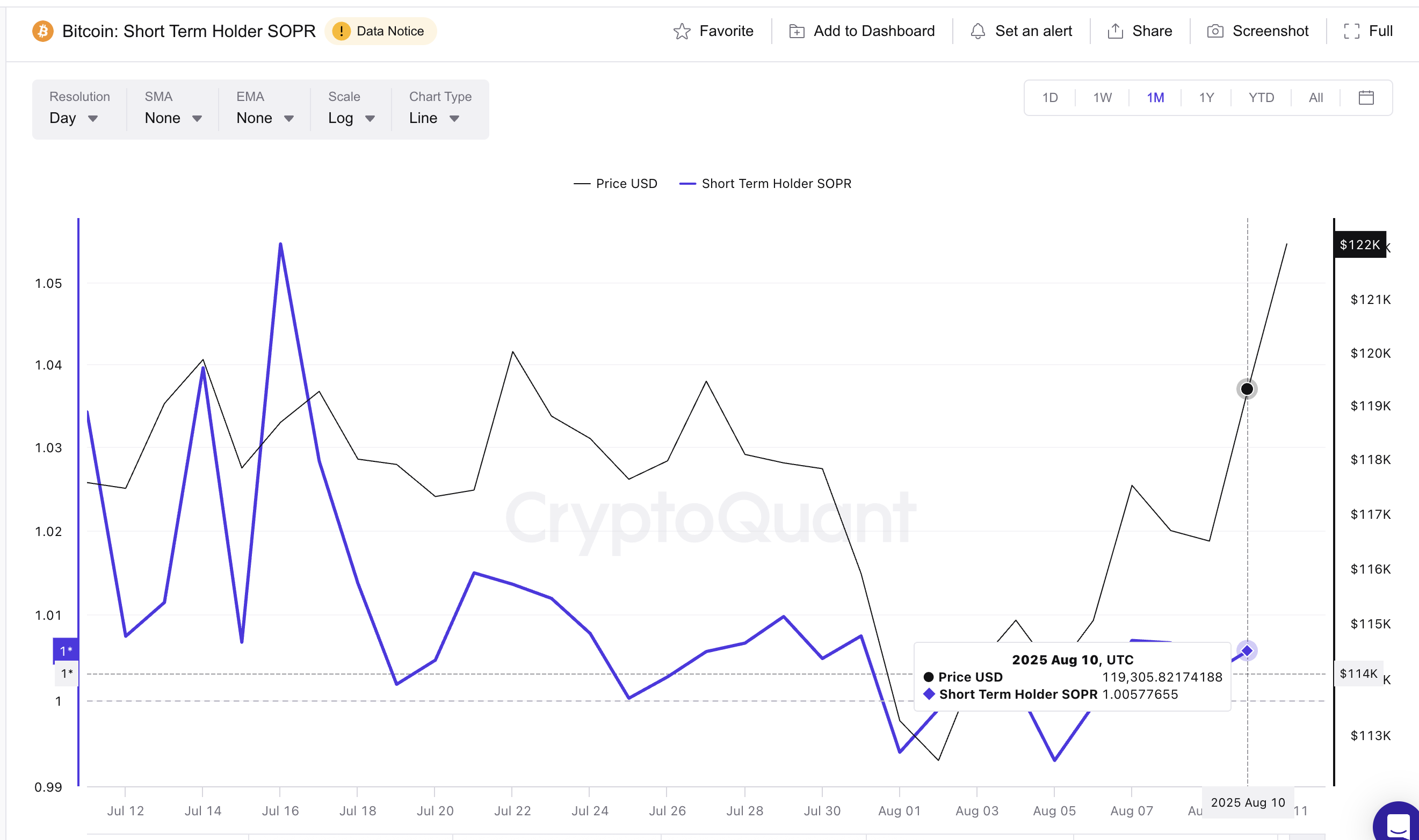

SOPR indicator indicates a large rally

The indicators of the short -term output profit (SOPR) measure if the displaced parts are sold to the chain with a profit or loss. When the short -term sopr increases too much, it signals aggressive gains, often in front of the local peaks.

SOPR short -term holders are particularly important in this analysis, because at the aggressive peaks of prices is often short -term holders who start selling first.

At the top of 14th July, soprisy climbed to an overheated level between 1.03 and 1.05, which is an alarm signal that the bitcoin rally has been exhausted. Today it is 1.00, which shows that the benefits are less aggressive. This suggests a healthier market structure and assembly that has not yet reached saturation.

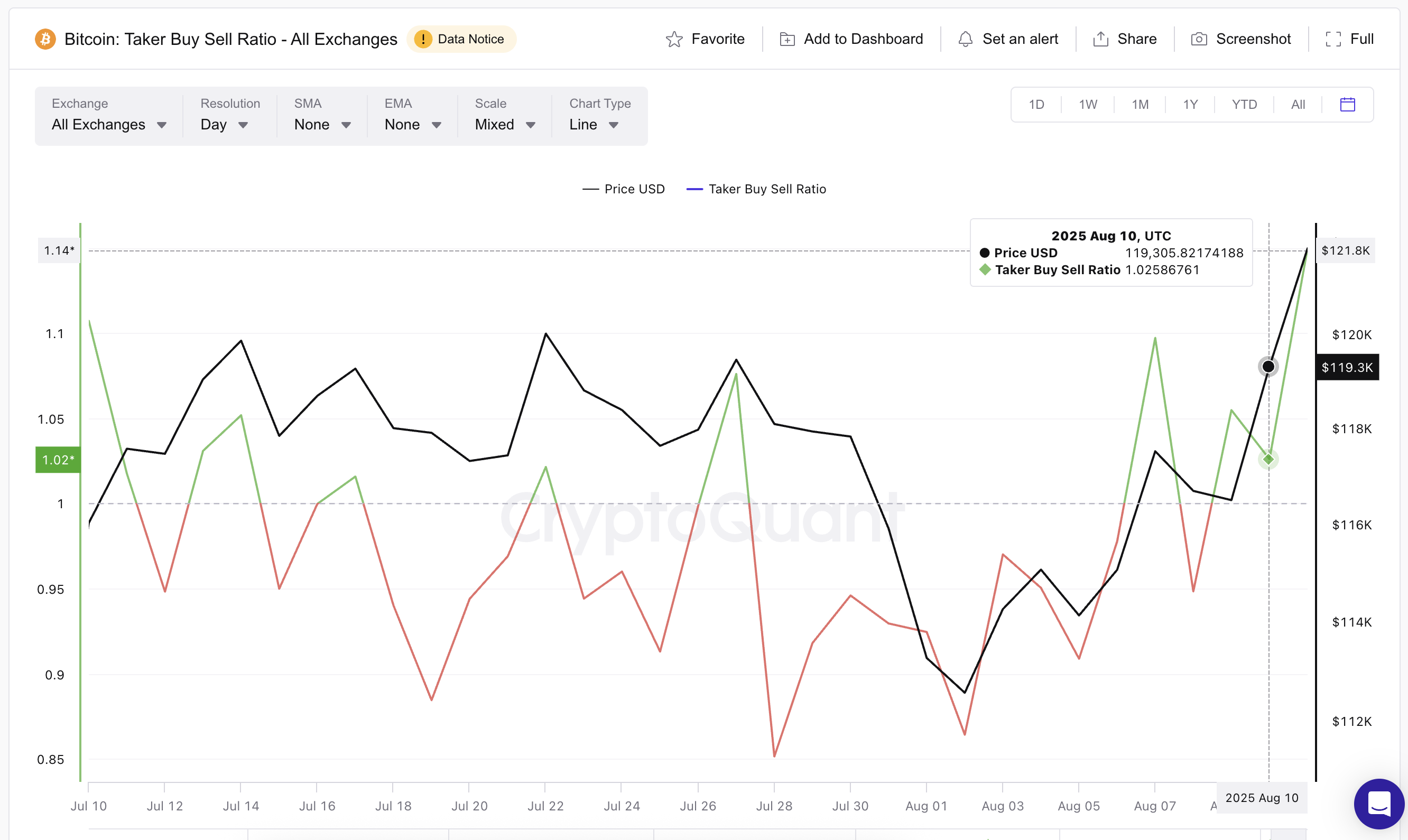

Signals that point to high demand

Cash flow flows confirm the ascending trend. Purchase/sale ratio, the recipient of purchasing domination or aggressive sales on the market since the beginning of July from the beginning of July from a neutral level of 1.02 of 1.02, its highest level.

This shows that buyers interfere with beliefs and overcome sellers.

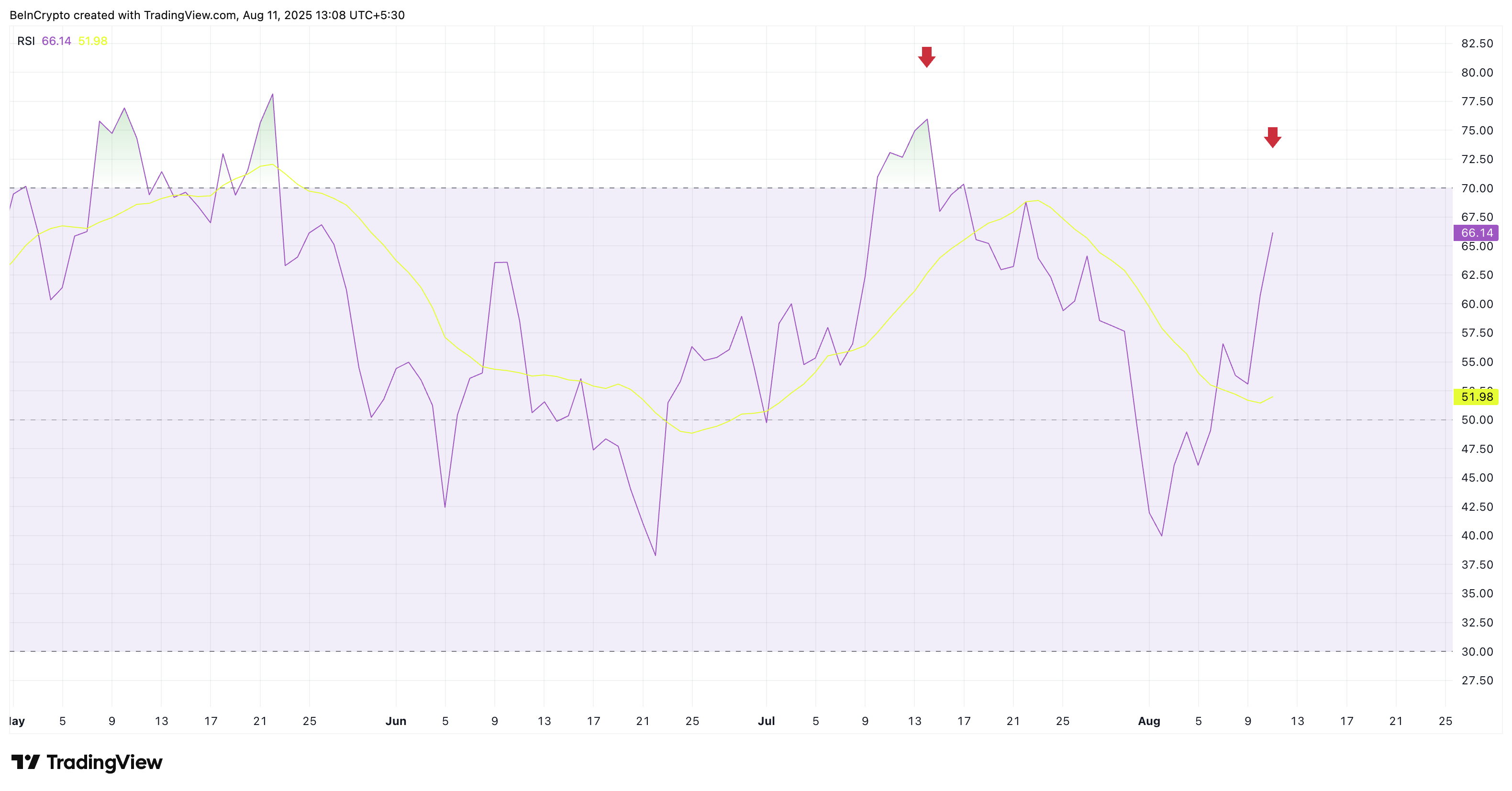

This observation is supported by the relative force index (RSI). 14th July was RSI on the territory of Surmahate over 75 years, which limited the increase. Currently, RSI is almost 66, while the price is only 0.6 % below its historical summit, significantly below the threshold above the exceeding, offering a bitcoin course more “maneuver room” before technical exhaustion.

We remind you that RSI (relative force of the index) is a momentum indicator that measures the speed and range of recent price movements on a scale of 0 to 100: Above 70 it can point to surraction, below 30 for the occurrence.

These indicators indicate that the rally could be extended after the current resistance zone. SOPR shows that this rally is not yet slowed down by achieving a massive profit. The recent jump of the recipient’s purchase/sales, associated with the RSI, which remains comfortably under the Surahat territory, suggests that the buyers have intent and technical margin to gather further.

Bitcoin focuses on the ascending breakthrough for even ATH

On daily graphics, Bitcoin is still evolving in a well -defined ascending channel. The price thus collides at the level of Fibonacci 1.0 of $ 123,230, the same area that limited the assembly of 14 July. A clear breakthrough at this level could allow him to focus on $ 130,231.

The key support to be monitored is $ 120,806 (FIB 0.786) and $ 118,903 (FIB 0.618). If the BTC is maintained above these levels, it would maintain a breakthrough hypothesis, while the fence below could slow down the momentum of the course.

If bull indicators maintain and a breakthrough exceeds $ 123,200 with volume, traders could see how new heights were formed faster than the last time, potentially higher than the market is currently expecting. However, a reduction of below $ 118,900 would cancel a short -term ascending trend.

Morality of History: The new ATH is just another resistance to overcome.

Notification of irresponsibility

Notice of irresponsibility: In accordance with the Trust project Directives, this article for price analysis is intended only for information purposes and must not be considered financial or investment advice. Beincrypto undertakes to provide accurate and impartial information, but market conditions may change without prior notice. Always carry out your own research before making any financial decision and consult a professional.